QuickBooks Component

Create and manage customers and invoices within Intuit QuickBooks

Component key: quickbooks

Description

QuickBooks is an accounting and payment platform for individuals and businesses. This component allows you to generate invoices, manage customers, and more within the QuickBooks platform.

API Documentation

This component was built using the QuickBooks Online API Documentation

The QuickBooks Sandbox allows developers to develop and test integrations without affecting real customer data. You can point your integrations at this sandbox as you assemble them.

Connections

QuickBooks OAuth 2.0

QuickBooks uses OAuth 2.0 to authenticate requests against the QuickBooks Online API.

- To configure an OAuth 2.0 credential through QuickBooks, you will need to create an app within the Intuit developer portal.

- When you create your app, be sure to enter Prismatic's OAuth callback URL

https://oauth2.prismatic.io/callbackfor US based integrations.- For integrations outside the US refer to this guide to find your region’s Callback URL.

- Consult QuickBooks to determine the proper OAuth Scopes to assign.

- Once the app has been created, you will be provided with a Client ID and Client Secret.

- Now, configure OAuth 2.0 settings in Prismatic. C1. reate a new credential of type OAuth 2.0 - Authorization Code.

- Enter the Client ID and Client Secret that you received from the Intuit developer portal.

- Set Scopes to any of the values in this list.

| Input | Default | Notes |

|---|---|---|

Authorize URL string / Required Hidden Field authorizeUrl | https://appcenter.intuit.com/connect/oauth2 | The OAuth 2.0 Authorization URL for QuickBooks |

Client ID string / Required clientId | ||

Client Secret password / Required clientSecret | ||

Revoke URL string / Required Hidden Field revokeUrl | https://developer.api.intuit.com/v2/oauth2/tokens/revoke | The OAuth 2.0 Revocation URL for QuickBooks |

Scopes string / Required scopes | com.intuit.quickbooks.accounting | A space-delimited set of one or more scopes to get the user's permission to access. |

Token URL string / Required Hidden Field tokenUrl | https://oauth.platform.intuit.com/oauth2/v1/tokens/bearer | The OAuth 2.0 Token URL for QuickBooks |

Use Sandbox boolean / Required useSandbox | false | Choose whether or not to use QuickBooks' sandbox. This is helpful for integration testing. |

Actions

Batch Request

Perform a batch request | key: batchRequest

| Input | Default | Notes | Example |

|---|---|---|---|

Batch Request Items code / Required batchRequestItems | An array of batch request items to be executed, each conforming to the Prismatic documentation format; see https://developer.intuit.com/app/developer/qbo/docs/api/accounting/all-entities/batch for detailed information. | ||

Connection connection / Required connection | |||

Debug Request boolean debug | false | Enabling this flag will log out the current request. |

Example Payload for Batch Request

{

"data": {

"BatchItemResponse": [

{

"Fault": {

"type": "ValidationFault",

"Error": [

{

"Message": "Stale Object Error",

"code": "5010",

"Detail": "Stale Object Error : You and root were working on this at the same time. root finished before you did, so your work was not saved.",

"element": ""

}

]

},

"bId": "bid1"

},

{

"bId": "bid2",

"QueryResponse": {

"SalesReceipt": [

{

"TxnDate": "2015-08-25",

"domain": "QBO",

"CurrencyRef": {

"name": "United States Dollar",

"value": "USD"

},

"PrintStatus": "NotSet",

"PaymentRefNum": "10264",

"TotalAmt": 337.5,

"Line": [

{

"Description": "Custom Design",

"DetailType": "SalesItemLineDetail",

"SalesItemLineDetail": {

"TaxCodeRef": {

"value": "NON"

},

"Qty": 4.5,

"UnitPrice": 75,

"ItemRef": {

"name": "Design",

"value": "4"

}

},

"LineNum": 1,

"Amount": 337.5,

"Id": "1"

},

{

"DetailType": "SubTotalLineDetail",

"Amount": 337.5,

"SubTotalLineDetail": {}

}

],

"ApplyTaxAfterDiscount": false,

"DocNumber": "1003",

"PrivateNote": "A private note.",

"sparse": false,

"DepositToAccountRef": {

"name": "Checking",

"value": "35"

},

"CustomerMemo": {

"value": "Thank you for your business and have a great day!"

},

"Balance": 0,

"CustomerRef": {

"name": "Dylan Sollfrank",

"value": "6"

},

"TxnTaxDetail": {

"TotalTax": 0

},

"SyncToken": "1",

"PaymentMethodRef": {

"name": "Check",

"value": "2"

},

"EmailStatus": "NotSet",

"BillAddr": {

"Lat": "INVALID",

"Long": "INVALID",

"Id": "49",

"Line1": "Dylan Sollfrank"

},

"MetaData": {

"CreateTime": "2015-08-27T14:59:48-07:00",

"LastUpdatedTime": "2016-04-15T09:01:10-07:00"

},

"CustomField": [

{

"DefinitionId": "1",

"Type": "StringType",

"Name": "Crew #"

}

],

"Id": "11"

}

],

"startPosition": 1,

"maxResults": 1

}

}

],

"time": "2016-04-15T09:01:18.141-07:00"

}

}

Create a refund receipt

Create a new Refund Receipt in QuickBooks | key: createRefundReceipt

| Input | Default | Notes | Example |

|---|---|---|---|

Account Id string accountId | Provide a value for the Id of the account to which payment money is deposited. If you do not specify this account, payment is applied to the Undeposited Funds account. | 35 | |

Account Name string accountName | Provide a value for the name of the account to which payment money is deposited. If you do not specify this account, payment is applied to the Undeposited Funds account. | Checking | |

Billing Address Id string billingAddressId | Provide the unique identifier of the billing address. | 78 | |

Custom Fields code customFields | Specify any optional custom fields to be attached. A custom field is a JavaScript Object that consists of a DefinitionId: String, Type: String, and Name: String. If you don't want to supply any custom fields, simply provide an empty JavaScript Array [] | ||

Debug Request boolean debug | false | Enabling this flag will log out the current request. | |

Optional Values string Key Value List fieldValues | The names of optional fields and their values to use when creating/updating a record. For example, if you have a custom configured field that is not represented as an input, here you are able to specify its key and assign it a value. | ||

Billing Latitude string lat | Provide a value for the latitude of the billing address. | 40.7489277 | |

Billing Line 1 string line1 | Provide a value for line 1 of the billing address. | Karen Pye | |

Billing Line 2 string line2 | Provide a value for line 2 of the billing address. | Pye's Cakes | |

Billing Line 3 string line3 | Provide a value for line 3 of the billing address. | 350 Mountain View Dr. | |

Billing Line 4 string line4 | Provide a value for line 4 of the billing address. | South Orange, NJ 07079 | |

Line Items code / Required lineItems | For each list item, provide a JavaScript Object that represents an individual line item. Please follow the shape provided in the example. For more information on the line item object refer to the QuickBooks documentation: https://developer.intuit.com/app/developer/qbo/docs/api/accounting/all-entities/salesreceipt#create-a-salesreceipt | ||

Billing Longitude string long | Provide a value for the longitude of the billing address. | -74.2609903 | |

Connection connection / Required quickbooksConnection |

Create a sales receipt

Create a new Sales Receipt in QuickBooks | key: createReceipt

| Input | Default | Notes | Example |

|---|---|---|---|

Account Id string accountId | Provide a value for the Id of the account to which payment money is deposited. If you do not specify this account, payment is applied to the Undeposited Funds account. | 35 | |

Account Name string accountName | Provide a value for the name of the account to which payment money is deposited. If you do not specify this account, payment is applied to the Undeposited Funds account. | Checking | |

Apply Tax After Discount boolean / Required applyTaxAfterDiscount | false | Specify weather or not to apply tax after discount. | |

Create Time string createTime | Provide a date time value for the point in time this record was created | 2014-09-16T14:59:48-07:00 | |

Customer Id string customerId | false | Provide a value for the Id of the customer you would like to attach to the receipt. | 56 |

Customer Name string customerName | Provide a value for the name of the customer that will show on the receipt. | John Doe | |

Custom Fields code customFields | Specify any optional custom fields to be attached. A custom field is a JavaScript Object that consists of a DefinitionId: String, Type: String, and Name: String. If you don't want to supply any custom fields, simply provide an empty JavaScript Array [] | ||

Debug Request boolean debug | false | Enabling this flag will log out the current request. | |

Line Items code / Required lineItems | For each list item, provide a JavaScript Object that represents an individual line item. Please follow the shape provided in the example. For more information on the line item object refer to the QuickBooks documentation: https://developer.intuit.com/app/developer/qbo/docs/api/accounting/all-entities/salesreceipt#create-a-salesreceipt | ||

Payment Method Id string paymentMethodId | Provide a value for the id of a payment method associated with this transaction. | 2 | |

Payment Method Name string paymentMethodName | Provide a value for the name of a payment method associated with this transaction. | Check | |

Connection connection / Required quickbooksConnection |

Create Invoice

Create an Invoice with the specified data | key: createInvoice

| Input | Default | Notes |

|---|---|---|

Data code / Required data | This is a string of JSON data that represents a QuickBooks invoice. | |

Debug Request boolean debug | false | Enabling this flag will log out the current request. |

Connection connection / Required quickbooksConnection |

Create Item

Create a new non-inventory item in QuickBooks | key: createNonInventoryItem

| Input | Default | Notes | Example |

|---|---|---|---|

Debug Request boolean debug | false | Enabling this flag will log out the current request. | |

Non-Inventory Item Data code nonInventoryItemData | The attributes of the non-inventory item to create | ||

Connection connection / Required quickbooksConnection |

Create Note Attachment

Use this endpoint to attach a note to an object. | key: createNoteAttachment

| Input | Default | Notes | Example |

|---|---|---|---|

Connection connection / Required connection | |||

Debug Request boolean debug | false | Enabling this flag will log out the current request. | |

Entity Reference Type string entityRefType | Object reference to which this attachment is linked. Set this value with the specific type of the target object. | Invoice | |

Entity Reference Value string entityRefValue | Object reference to which this attachment is linked. Set this value with the Id of the target object as returned in its response body when queried. | 95 | |

Include on Send boolean includeOnSend | false | Used when Entity Reference Type references a transaction object. This field indicates whether or not the attachment is sent with the transaction when Save and Send button is clicked in the QuickBooks UI or when the Send endpoint (send email) is invoked for the object. | |

API Minor Version string minorVersion | 69 | Provide the version of the API you would like to use. | 59 |

Note string / Required note | The note is either related to the attachment specified with the FileName attribute, or as a standalone note. Required for note attachments. |

Create Purchase Order

Create a new Purchase Order | key: createPurchaseOrder

| Input | Default | Notes |

|---|---|---|

AP Account ID string / Required apAccountId | The AP account to which the bill is credited | |

Connection connection / Required connection | ||

Debug Request boolean debug | false | Enabling this flag will log out the current request. |

Dynamic Fields data dynamicValues | A field for dynamic inputs that can be configured at deploy time with the use of a key/value config variable. | |

Optional Values string Key Value List fieldValues | The names of optional fields and their values to use when creating/updating a record. For example, if you have a custom configured field that is not represented as an input, here you are able to specify its key and assign it a value. | |

Lines data / Required lines | Data representing line items of Purchase Orders; see 'Line' in QuickBooks' docs at https://developer.intuit.com/app/developer/qbo/docs/api/accounting/all-entities/purchaseorder#create-a-purchase-order | |

Vendor ID string / Required vendorId | The Vendor referenced in this transaction |

Example Payload for Create Purchase Order

{

"data": {

"PurchaseOrder": {

"DocNumber": "1005",

"SyncToken": "0",

"POEmail": {

"Address": "send_email@intuit.com"

},

"APAccountRef": {

"name": "Accounts Payable (A/P)",

"value": "33"

},

"CurrencyRef": {

"name": "United States Dollar",

"value": "USD"

},

"TxnDate": "2015-07-28",

"TotalAmt": 25,

"ShipAddr": {

"Line4": "Half Moon Bay, CA 94213",

"Line3": "65 Ocean Dr.",

"Id": "121",

"Line1": "Grace Pariente",

"Line2": "Cool Cars"

},

"domain": "QBO",

"Id": "257",

"POStatus": "Open",

"sparse": false,

"EmailStatus": "NotSet",

"VendorRef": {

"name": "Hicks Hardware",

"value": "41"

},

"Line": [

{

"DetailType": "ItemBasedExpenseLineDetail",

"Amount": 25,

"Id": "1",

"ItemBasedExpenseLineDetail": {

"ItemRef": {

"name": "Garden Supplies",

"value": "38"

},

"CustomerRef": {

"name": "Cool Cars",

"value": "3"

},

"Qty": 1,

"TaxCodeRef": {

"value": "NON"

},

"BillableStatus": "NotBillable",

"UnitPrice": 25

}

}

],

"CustomField": [

{

"DefinitionId": "1",

"Type": "StringType",

"Name": "Crew #"

},

{

"DefinitionId": "2",

"Type": "StringType",

"Name": "Sales Rep"

}

],

"VendorAddr": {

"Line4": "Middlefield, CA 94303",

"Line3": "42 Main St.",

"Id": "120",

"Line1": "Geoff Hicks",

"Line2": "Hicks Hardware"

},

"MetaData": {

"CreateTime": "2015-07-28T16:01:47-07:00",

"LastUpdatedTime": "2015-07-28T16:01:47-07:00"

}

},

"time": "2015-07-28T16:04:49.874-07:00"

}

}

Create Resource

Create a new resource in QuickBooks | key: createResource

| Input | Default | Notes |

|---|---|---|

Debug Request boolean debug | false | Enabling this flag will log out the current request. |

Connection connection / Required quickbooksConnection | ||

Resource Attributes data Key Value List resourceAttributes | A list of attributes used to create a resource in QuickBooks. For more information refer to https://developer.intuit.com/app/developer/qbo/docs/api/accounting/all-entities/customer. | |

Resource Type string / Required resourceType |

Delete a refund receipt

Delete an existing Refund Receipt in QuickBooks | key: deleteRefundReceipt

| Input | Default | Notes | Example |

|---|---|---|---|

Debug Request boolean debug | false | Enabling this flag will log out the current request. | |

Connection connection / Required quickbooksConnection | |||

Receipt Id string / Required receiptId | Provide a value for the Id of the receipt. | 101 | |

Sync Token string / Required syncToken | The Sync Token of a resource in QuickBooks |

Delete Attachable

This operation deletes an attachable object. | key: deleteAttachable

| Input | Default | Notes | Example |

|---|---|---|---|

Attachable Payload data / Required attachablePayload | The full payload of the attachable as returned in a read response. Could be a reference from a previously executed "Read an Attachable" action response data. | ||

Connection connection / Required connection | |||

Debug Request boolean debug | false | Enabling this flag will log out the current request. | |

API Minor Version string minorVersion | 69 | Provide the version of the API you would like to use. | 59 |

Delete Purchase Order

Delete an existing Purchase Order | key: deletePurchaseOrder

| Input | Default | Notes | Example |

|---|---|---|---|

Connection connection / Required connection | |||

Debug Request boolean debug | false | Enabling this flag will log out the current request. | |

Id string / Required id | This represents a resource's unique ID. It must be an integer number. | 1234 | |

Sync Token string / Required syncToken | The Sync Token of a resource in QuickBooks |

Example Payload for Delete Purchase Order

{

"data": {

"PurchaseOrder": {

"status": "Deleted",

"domain": "QBO",

"Id": "125"

},

"time": "2015-05-26T14:08:39.858-07:00"

}

}

Download Attachment

Retrieves a temporary download URL to the specified attachableID. | key: downloadAttachment

| Input | Default | Notes | Example |

|---|---|---|---|

Attachable Id string / Required attachableId | The unique identifier of the attachment | 5000000000001348400 | |

Connection connection / Required connection | |||

Debug Request boolean debug | false | Enabling this flag will log out the current request. | |

API Minor Version string minorVersion | 69 | Provide the version of the API you would like to use. | 59 |

Find Resource by Id

Returns a full Resource in QuickBooks | key: findResource

| Input | Default | Notes |

|---|---|---|

Debug Request boolean debug | false | Enabling this flag will log out the current request. |

Connection connection / Required quickbooksConnection | ||

Id string / Required resourceId | The Primary ID of a resource in QuickBooks | |

Resource Type string / Required resourceType |

Get a refund receipt

Get the value of an existing Refund Receipt in QuickBooks | key: getRefundReceipt

| Input | Default | Notes | Example |

|---|---|---|---|

Debug Request boolean debug | false | Enabling this flag will log out the current request. | |

Connection connection / Required quickbooksConnection | |||

Receipt Id string / Required receiptId | Provide a value for the Id of the receipt. | 101 |

Get a refund receipt as PDF

Get the value of an existing Refund Receipt in QuickBooks as a PDF | key: getRefundReceiptAsPDF

| Input | Default | Notes | Example |

|---|---|---|---|

Debug Request boolean debug | false | Enabling this flag will log out the current request. | |

Connection connection / Required quickbooksConnection | |||

Receipt Id string / Required receiptId | Provide a value for the Id of the receipt. | 101 |

Get Company Info

Retrieve information about the company | key: getCompanyInfo

| Input | Default | Notes |

|---|---|---|

Debug Request boolean debug | false | Enabling this flag will log out the current request. |

Connection connection / Required quickbooksConnection |

Example Payload for Get Company Info

{

"data": {

"CompanyName": "Example Corp",

"Id": "1234",

"SyncToken": "exampleSyncToken",

"CompanyAddr": {

"City": "Mountain View",

"Country": "USA",

"CountrySubDviisionCode": "CA",

"Line1": "2500 Garcia Ave",

"PostalCode": "94043"

}

}

}

Get Customer By Display Name

Retrieve information about the Customer which matches the given Display Name | key: getCustomerByDisplayName

| Input | Default | Notes | Example |

|---|---|---|---|

Customer Display Name string / Required customerDisplayName | This represents the customer's display name | Smith Rocket Company | |

Debug Request boolean debug | false | Enabling this flag will log out the current request. | |

Connection connection / Required quickbooksConnection |

Example Payload for Get Customer By Display Name

{

"data": {

"Id": "exampleId",

"SyncToken": "asdf123",

"MetaData": {},

"EmailMessagesPrefs": {},

"ProductAndServicesPrefs": {},

"ReportPrefs": {}

}

}

Get Customer By Id

Retrieve information about the Customer which matches the given id | key: getCustomerById

| Input | Default | Notes | Example |

|---|---|---|---|

Debug Request boolean debug | false | Enabling this flag will log out the current request. | |

Id string / Required id | This represents a resource's unique ID. It must be an integer number. | 1234 | |

Connection connection / Required quickbooksConnection |

Example Payload for Get Customer By Id

{

"data": {

"Id": "exampleId",

"SyncToken": "asdf123",

"MetaData": {},

"EmailMessagesPrefs": {},

"ProductAndServicesPrefs": {},

"ReportPrefs": {}

}

}

Get Invoice By Id

Retrieve information about the Invoice which matches the given id | key: getInvoiceById

| Input | Default | Notes | Example |

|---|---|---|---|

Debug Request boolean debug | false | Enabling this flag will log out the current request. | |

Id string / Required id | This represents a resource's unique ID. It must be an integer number. | 1234 | |

Connection connection / Required quickbooksConnection |

Get Resource

Retrieve a QuickBooks resource using their SQL-like data query language | key: queryResource

| Input | Default | Notes | Example |

|---|---|---|---|

Debug Request boolean debug | false | Enabling this flag will log out the current request. | |

API Minor Version string minorVersion | Provide the version of the API you would like to use. | 59 | |

Query String string / Required queryString | Must be a valid query string as defined by the QuickBooks API. Single quotes must be escaped with a backslash. | select * from department | |

Connection connection / Required quickbooksConnection |

This action allows for sending queries to the Query endpoint. Please refer to QuickBooks' documentation for building custom queries.

Get Sales Receipt

Get the information and metadata of a Sales Receipt by Id | key: getReceipt

| Input | Default | Notes | Example |

|---|---|---|---|

Debug Request boolean debug | false | Enabling this flag will log out the current request. | |

Connection connection / Required quickbooksConnection | |||

Receipt Id string / Required receiptId | Provide a value for the Id of the receipt. | 101 |

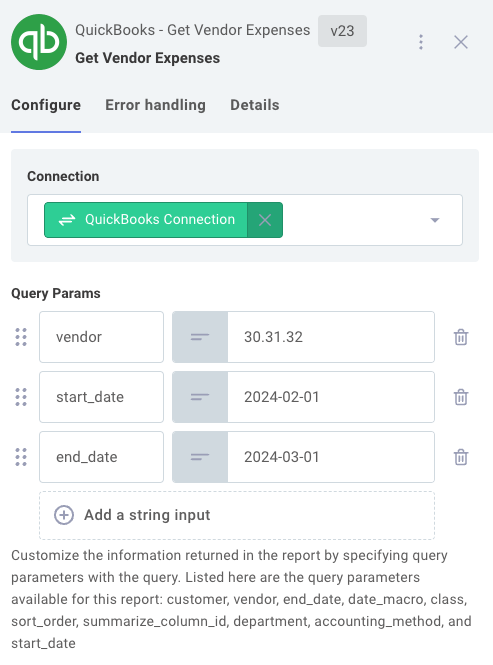

Get Vendor Expenses

Retrieve information about vendor expenses | key: queryVendorExpenses

| Input | Default | Notes |

|---|---|---|

Debug Request boolean debug | false | Enabling this flag will log out the current request. |

Query Params string Key Value List queryParams | Customize the information returned in the report by specifying query parameters with the query. Listed here are the query parameters available for this report: customer, vendor, end_date, date_macro, class, sort_order, summarize_column_id, department, accounting_method, and start_date | |

Connection connection / Required quickbooksConnection |

This action wraps QuickBooks' Query a Report API endpoint.

Query parameters can be added to filter results by customer, vendor, department, accounting_method, or class.

Keys summarize_column_by and sort_order determine how the result should be structured.

You can also specify a date_macro, or a combination of a start_date and end_date (both need to be specified) to get expenses from a particular date range.

Raw Request

Send raw HTTP request to QuickBooks | key: rawRequest

| Input | Default | Notes | Example |

|---|---|---|---|

Connection connection / Required connection | |||

Data string data | The HTTP body payload to send to the URL. | {"exampleKey": "Example Data"} | |

Debug Request boolean debugRequest | false | Enabling this flag will log out the current request. | |

File Data string Key Value List fileData | File Data to be sent as a multipart form upload. | [{key: "example.txt", value: "My File Contents"}] | |

Form Data string Key Value List formData | The Form Data to be sent as a multipart form upload. | [{"key": "Example Key", "value": new Buffer("Hello World")}] | |

Header string Key Value List headers | A list of headers to send with the request. | User-Agent: curl/7.64.1 | |

Max Retry Count string maxRetries | 0 | The maximum number of retries to attempt. | |

Method string / Required method | The HTTP method to use. | ||

Query Parameter string Key Value List queryParams | A list of query parameters to send with the request. This is the portion at the end of the URL similar to ?key1=value1&key2=value2. | ||

Response Type string / Required responseType | json | The type of data you expect in the response. You can request json, text, or binary data. | |

Retry On All Errors boolean retryAllErrors | false | If true, retries on all erroneous responses regardless of type. | |

Retry Delay (ms) string retryDelayMS | 0 | The delay in milliseconds between retries. | |

Timeout string timeout | The maximum time that a client will await a response to its request | 2000 | |

URL string / Required url | Input the path only (/invoice), The base URL is already included (https://quickbooks.api.intuit.com/v3/company/1234567890 for production or https://sandbox-quickbooks.api.intuit.com/v3/company/1234567890 for sandbox). For example, to connect to https://quickbooks.api.intuit.com/v3/company/1234567890/invoice, only /invoice is entered in this field. | /invoice | |

Use Exponential Backoff boolean useExponentialBackoff | false | Specifies whether to use a pre-defined exponential backoff strategy for retries. |

Read an Attachable

Read one attachable | key: readAnAttachable

| Input | Default | Notes | Example |

|---|---|---|---|

Attachable Id string / Required attachableId | The unique identifier of the attachment | 5000000000001348400 | |

Connection connection / Required connection | |||

Debug Request boolean debug | false | Enabling this flag will log out the current request. | |

API Minor Version string minorVersion | 69 | Provide the version of the API you would like to use. | 59 |

Send a refund receipt

send an existing Refund Receipt to the email saved in QuickBooks | key: sendRefundReceipt

| Input | Default | Notes | Example |

|---|---|---|---|

Debug Request boolean debug | false | Enabling this flag will log out the current request. | |

Connection connection / Required quickbooksConnection | |||

Receipt Id string / Required receiptId | Provide a value for the Id of the receipt. | 101 |

Send a refund receipt

Send an existing Refund Receipt in QuickBooks to any email | key: sendRefundReceiptToEmail

| Input | Default | Notes | Example |

|---|---|---|---|

Debug Request boolean debug | false | Enabling this flag will log out the current request. | |

Email string / Required email | Provide a valid email to send the receipt to. | someone@example.com | |

Connection connection / Required quickbooksConnection | |||

Receipt Id string / Required receiptId | Provide a value for the Id of the receipt. | 101 |

Update Attachable

Update any of the writable fields of an existing attachable object. | key: updateAttachable

| Input | Default | Notes | Example |

|---|---|---|---|

Connection connection / Required connection | |||

Debug Request boolean debug | false | Enabling this flag will log out the current request. | |

API Minor Version string minorVersion | 69 | Provide the version of the API you would like to use. | 59 |

Update Request Body code / Required updateRequestBody | The request body must include all writable fields of the existing object as returned in a read response. Writable fields omitted from the request body are set to NULL. The ID of the object to update is specified in the request body. |

Update Purchase Order

Update an existing Purchase Order | key: updatePurchaseOrder

| Input | Default | Notes | Example |

|---|---|---|---|

AP Account ID string apAccountId | The AP account to which the bill is credited | ||

Base Record data baseRecord | Reference the existing record (from 'Get Resource' or other action) or desired base record; QuickBooks only does 'full' updates and treats unspecified keys as clearing out that field | ||

Connection connection / Required connection | |||

Debug Request boolean debug | false | Enabling this flag will log out the current request. | |

Dynamic Fields data dynamicValues | A field for dynamic inputs that can be configured at deploy time with the use of a key/value config variable. | ||

Optional Values string Key Value List fieldValues | The names of optional fields and their values to use when creating/updating a record. For example, if you have a custom configured field that is not represented as an input, here you are able to specify its key and assign it a value. | ||

Id string / Required id | This represents a resource's unique ID. It must be an integer number. | 1234 | |

Lines data lines | Data representing line items of Purchase Orders; see 'Line' in QuickBooks' docs at https://developer.intuit.com/app/developer/qbo/docs/api/accounting/all-entities/purchaseorder#create-a-purchase-order | ||

Sync Token string / Required syncToken | The Sync Token of a resource in QuickBooks | ||

Vendor ID string vendorId | The Vendor referenced in this transaction |

Example Payload for Update Purchase Order

{

"data": {

"PurchaseOrder": {

"DocNumber": "1005",

"SyncToken": "0",

"POEmail": {

"Address": "send_email@intuit.com"

},

"APAccountRef": {

"name": "Accounts Payable (A/P)",

"value": "33"

},

"CurrencyRef": {

"name": "United States Dollar",

"value": "USD"

},

"TxnDate": "2015-07-28",

"TotalAmt": 25,

"ShipAddr": {

"Line4": "Half Moon Bay, CA 94213",

"Line3": "65 Ocean Dr.",

"Id": "121",

"Line1": "Grace Pariente",

"Line2": "Cool Cars"

},

"domain": "QBO",

"Id": "257",

"POStatus": "Open",

"sparse": false,

"EmailStatus": "NotSet",

"VendorRef": {

"name": "Hicks Hardware",

"value": "41"

},

"Line": [

{

"DetailType": "ItemBasedExpenseLineDetail",

"Amount": 25,

"Id": "1",

"ItemBasedExpenseLineDetail": {

"ItemRef": {

"name": "Garden Supplies",

"value": "38"

},

"CustomerRef": {

"name": "Cool Cars",

"value": "3"

},

"Qty": 1,

"TaxCodeRef": {

"value": "NON"

},

"BillableStatus": "NotBillable",

"UnitPrice": 25

}

}

],

"CustomField": [

{

"DefinitionId": "1",

"Type": "StringType",

"Name": "Crew #"

},

{

"DefinitionId": "2",

"Type": "StringType",

"Name": "Sales Rep"

}

],

"VendorAddr": {

"Line4": "Middlefield, CA 94303",

"Line3": "42 Main St.",

"Id": "120",

"Line1": "Geoff Hicks",

"Line2": "Hicks Hardware"

},

"MetaData": {

"CreateTime": "2015-07-28T16:01:47-07:00",

"LastUpdatedTime": "2015-07-28T16:01:47-07:00"

}

},

"time": "2015-07-28T16:04:49.874-07:00"

}

}

Update refund receipt

Update the contents of an existing Refund Receipt in QuickBooks | key: updateRefundReceipt

| Input | Default | Notes | Example |

|---|---|---|---|

Billing Address Id string billingAddressId | Provide the unique identifier of the billing address. | 78 | |

Custom Fields code customFields | Specify any optional custom fields to be attached. A custom field is a JavaScript Object that consists of a DefinitionId: String, Type: String, and Name: String. If you don't want to supply any custom fields, simply provide an empty JavaScript Array [] | ||

Debug Request boolean debug | false | Enabling this flag will log out the current request. | |

Optional Values string Key Value List fieldValues | The names of optional fields and their values to use when creating/updating a record. For example, if you have a custom configured field that is not represented as an input, here you are able to specify its key and assign it a value. | ||

Billing Latitude string lat | Provide a value for the latitude of the billing address. | 40.7489277 | |

Billing Line 1 string line1 | Provide a value for line 1 of the billing address. | Karen Pye | |

Billing Line 2 string line2 | Provide a value for line 2 of the billing address. | Pye's Cakes | |

Billing Line 3 string line3 | Provide a value for line 3 of the billing address. | 350 Mountain View Dr. | |

Billing Line 4 string line4 | Provide a value for line 4 of the billing address. | South Orange, NJ 07079 | |

Line Items code / Required lineItems | For each list item, provide a JavaScript Object that represents an individual line item. Please follow the shape provided in the example. For more information on the line item object refer to the QuickBooks documentation: https://developer.intuit.com/app/developer/qbo/docs/api/accounting/all-entities/salesreceipt#create-a-salesreceipt | ||

Billing Longitude string long | Provide a value for the longitude of the billing address. | -74.2609903 | |

Connection connection / Required quickbooksConnection | |||

Receipt Id string / Required receiptId | Provide a value for the Id of the receipt. | 101 | |

Sync Token string / Required syncToken | The Sync Token of a resource in QuickBooks | ||

Total Amount string / Required totalAmount | Provide a value for the total amount on the receipt. | 150 |

Update Resource

Updates a Resource in QuickBooks | key: updateResource

| Input | Default | Notes |

|---|---|---|

Debug Request boolean debug | false | Enabling this flag will log out the current request. |

Connection connection / Required quickbooksConnection | ||

Resource Attributes data Key Value List resourceAttributes | A list of attributes used to create a resource in QuickBooks. For more information refer to https://developer.intuit.com/app/developer/qbo/docs/api/accounting/all-entities/customer. | |

Resource Data data resourceData | An optional full map of the resource data | |

Id string / Required resourceId | The Primary ID of a resource in QuickBooks | |

Resource Type string / Required resourceType | ||

Sync Token string / Required syncToken | The Sync Token of a resource in QuickBooks |

Upload Attachment

Upload one attachment | key: uploadAttachment

| Input | Default | Notes | Example |

|---|---|---|---|

Connection connection / Required connection | |||

Debug Request boolean debug | false | Enabling this flag will log out the current request. | |

Entity Reference Type string entityRefType | Object reference to which this attachment is linked. Set this value with the specific type of the target object. | Invoice | |

Entity Reference Value string entityRefValue | Object reference to which this attachment is linked. Set this value with the Id of the target object as returned in its response body when queried. | 95 | |

File data / Required file | File to attach. This should be a reference to a previous step | ||

File Name string / Required fileName | FileName of the attachment | receipt_nov15.jpg | |

File Type string / Required fileType | The file type of the attachment | ||

Include on Send boolean includeOnSend | false | Used when Entity Reference Type references a transaction object. This field indicates whether or not the attachment is sent with the transaction when Save and Send button is clicked in the QuickBooks UI or when the Send endpoint (send email) is invoked for the object. | |

API Minor Version string minorVersion | 69 | Provide the version of the API you would like to use. | 59 |

Note string note | The note is either related to the attachment specified with the FileName attribute, or as a standalone note. Required for note attachments. |

Void Invoice

Voids an Invoice | key: voidInvoice

| Input | Default | Notes | Example |

|---|---|---|---|

Debug Request boolean debug | false | Enabling this flag will log out the current request. | |

Id string / Required id | This represents a resource's unique ID. It must be an integer number. | 1234 | |

Connection connection / Required quickbooksConnection | |||

Sync Token string / Required syncToken | The Sync Token of a resource in QuickBooks |